1099 tax calculator

Looking for our Tax Withholding Product. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

The 1099 Tax Calculator will come in handy if youre self-employed.

. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. This tax form is for taxpayers who report an income from the government. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. You can use this calculator to estimate your 1099 income by week month quarter or year by configuring how much and how often you plan to work. The Freelance Tax Calculator powered by Painless1099 A simple headache-free way to calculate 1099 taxes.

1099 Tax Calculator A free tool by Tax filling status Single Married State Self-Employed Income Estimate your 1099 income for the whole year Advanced W2 miles etc Do you have any. Self-employed and worried about your taxes. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

Self Employment Tax Calculator. It is simple to figure out and can be utilized by people to enumerate their tax culpability. Up to 10 cash back TaxActs self-employed tax calculator helps determine your taxes due based on current self-employment tax rates.

Fret not this is your one-stop for all your tax needs. FlyFins self-employment tax calculator. The 1099 tax calculator for income is a good tool and is easy to use.

For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income. If the federal local or state government paid you unemployment benefits or a local tax refund. Home financial.

The calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation but its important to note that this is. Taxes Paid Filed - 100 Guarantee. Its easy to use and totally.

This is true even if you are paid in cash and do. Discover Helpful Information And Resources On Taxes From AARP. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

1099-G retirement pay 1099. Small business owners contractors freelancers gig workers and others whose net profit is greater than 400 are required to pay self. File your 1099 taxes in a jiffy.

Our calculator preserves sanity saves time. Painless1099 Calculator Income Tax Calculator Knowing how much you need to save for self-employment taxes shouldnt be rocket science. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

How to calculate your tax refund. Those who are expected to receive a few Forms 1099 such as INT or DIV reporting investment income dont really need to. This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income.

Transitioning From The 1099 Misc To The 1099 Nec Form How Does This Impact You

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

General Archives Businessman Talk

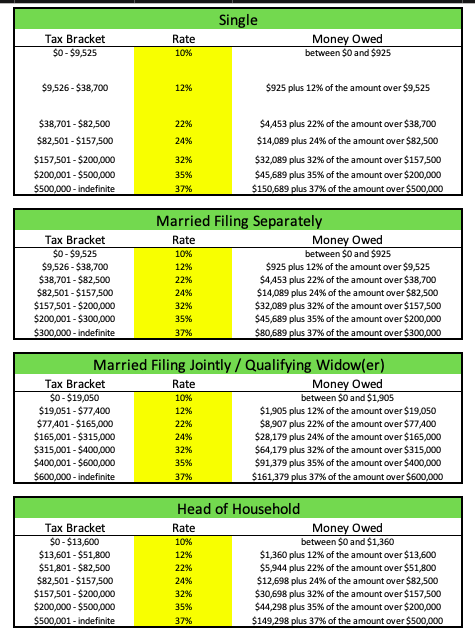

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub

What Is A 1099 K New Rules And How To Use It On Your Taxes

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

1099 Taxes Calculator Widget

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Estimated Tax Payments For Independent Contractors A Complete Guide

Self Employed Tax Calculator Deals Save 44 Srsconsultinginc Com

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

What Happens If You Miss A Quarterly Estimated Tax Payment

Estimated Tax Payments For Independent Contractors A Complete Guide

.png)

1099 Taxes Calculator Estimate Your Self Employment Taxes

Onlyfans 1099 Taxes How To Properly File

2020 Tax Changes For 1099 Independent Contractors Updated For 2020